Can accounting course lead you to a recession-proof career?

Today’s jobs market can be a scary thing. Even higher education can cause some anxiety: will you really be able to turn your qualifications into a career?

Fortunately, when it comes to accountancy, the answer is nearly always a massive ‘yes’! What about Artificial Intelligence (AI)? Will it replace accountants?

AI will transform, not replace accountants. In fact, according to a leading research firm, Gartner, AI is set to create more jobs than it will replace, leaving workers, including accountants with options. Accountants don’t have to worry about their job being replaced by AI any time in the near future

Now, obviously, employment will always come down to individual work ethic, but it’s safe to say that accountancy is one of the most ‘accountancy recession-proof’ careers out there.

Accounting Course certifications

There are so many types of certifications:

- Sijil Kemahiran Malaysia SKM3 & Diploma Kemahiran Malaysia DKM,

- LCCI (Level 1-4) & LCCI Diploma,

- Diploma in accounting

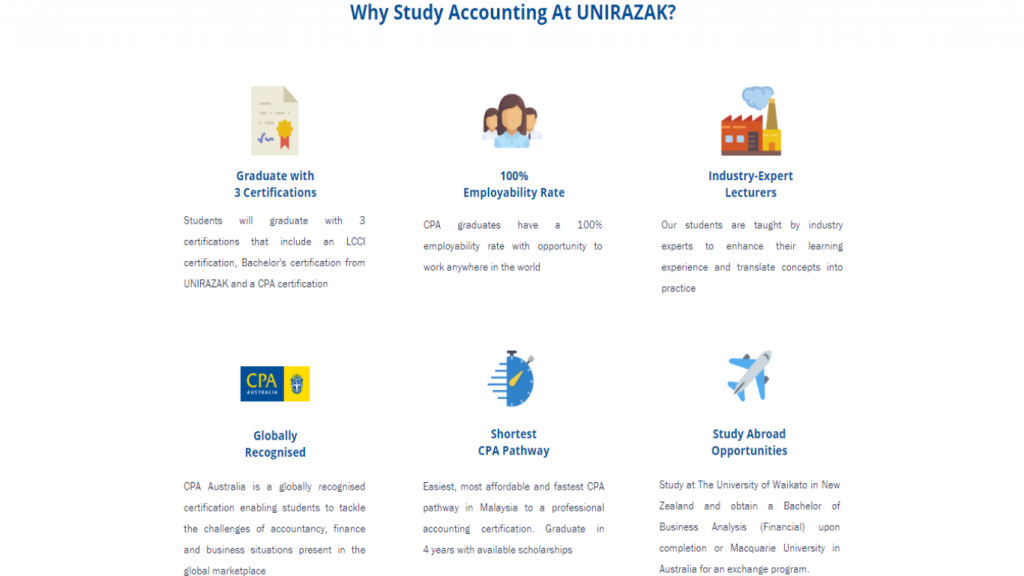

- Bachelor of Accounting (some with professional qualification eg CPA Australia)

- CPA Australia, ACCA, CIMA, MICPA and ICAEW

So which accounting course do you go for? Before that, let’s have some basic understanding of what is accounting.

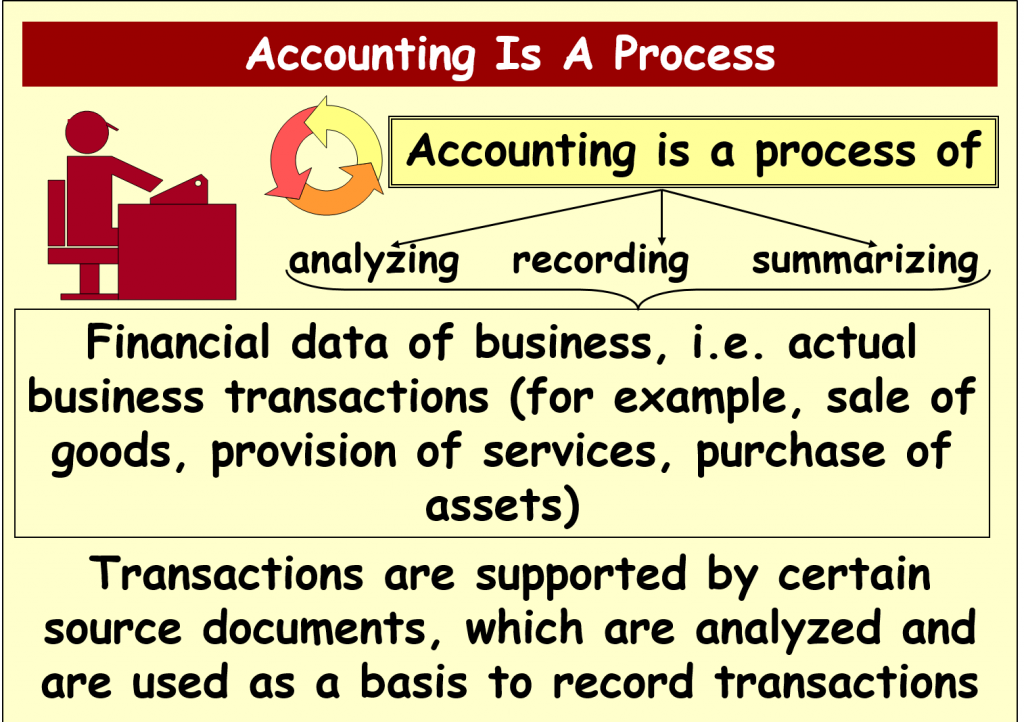

What is accounting?

Accounting is the process of recording financial transactions pertaining to a business. The accounting process includes summarizing, analyzing, and reporting these transactions to oversight agencies, regulators, and tax collection entities – Investopedia

What are main types of accounting?

Following are four main types of Accounting covered in a degree leading to a CPA:

| Type | What It Is All About |

|---|---|

| Management Accounting | Management accounting is the practice of identifying, measuring, analyzing, interpreting, and communicating financial information to managers for the pursuit of an organization’s goals. It varies from financial accounting because the intended purpose of managerial accounting is to assist users internal to the company in making well-informed business decisions. |

| Audit | A financial audit is an objective examination and evaluation of the financial statements of an organization to make sure that the financial records are a fair and accurate representation of the transactions they claim to represent – Investopedia |

| Tax Accounting | Tax accounting is a structure of accounting methods focused on taxes rather than the appearance of public financial statements. Tax accounting is governed by the Internal Revenue Code, which dictates the specific rules that companies and individuals must follow when preparing their tax returns – Investopedia |

| Financial Accounting | Financial accounting is a specific branch of accounting involving a process of recording, summarizing, and reporting the myriad of transactions resulting from business operations over a period of time – Investopedia |

So, what are the qualifications needed to be in this career?

Accounting course pathways (common ones)

Certificate

- Sijil Kemahiran Malaysia Level 3 in Accounting (FB-100-3:2012)

Who can apply?

The entrance requirement for SKM3 is just 16 years old. However, interest in Maths is strongly recommended if you want to take up the course. With SKM3 in accounting, it may just be enough for you to gain an entry-level to accounting job and automation may make this job diminish by 2025. Therefore, if you only have SKM3, it’s recommended to progress further by taking a Diploma in Accounting or Bachelors of Accounting. - LCCI Certificate – Who can apply?

You just need a SPM: Minimum 1 credit in Mathematics

LCCI’s Certificates provide the following benefits:

RECOGNITION – LCCI is recognized by Malaysian companies, both big and small, for its practical and relevant nature. Top professional bodies such as ACCA and CIMA also recognize LCCI qualifications.

INTERNATIONAL – LCCI’s quality is consistent around the world and gives students the assurance of a globally accepted qualification.

FLEXIBILITY – LCCI is suitable both for full-time students as well as busy working adults because its qualifications can be taken as short modules over a period of time.

Diploma

Diploma in Accounting – Who can apply?

Generally requires at least 3 credits (C and above) at SPM, O-Level or equivalent, including a credit in Mathematics and a pass in English.

For UEC students, you will need to have a minimum of 3Bs including Mathematics, plus a pass in English.

Degree

And if you start afresh after SPM (with min 3 credits including Maths & pass in English), then you may want to have the shortest path to a CPA through LCCI (4 years) or through Foundation (5 years).

Salary for Certification: Certified Public Accountant (CPA)